Truss Financial Group Expands Support for Veterans with Updated VA Loan Entitlement Guidelines

Truss Financial eases the path to homeownership for veterans in 2025 with enhanced VA loan limits, no PMI, and 100% cash-out refinancing.

CA, UNITED STATES, May 8, 2025 /EINPresswire.com/ -- In 2025, America’s veterans remain a pillar of strength, shaping the nation as leaders, entrepreneurs, and homeowners. As the housing market grows more complex, reliable, affordable home financing for veterans is crucial.

Recognizing this need, Truss Financial Group proudly supports service members and military families by incorporating the latest 2025 VA loan and high-balance loan updates, helping veterans maximize the benefits they’ve earned in today’s challenging market.

“Veterans have protected the American Dream for generations, it’s our responsibility to help them achieve it at home,” said Jason Nichols, CMO at Truss Financial Group. “With updated VA lending limits and enhanced flexibility, we’re making homeownership more accessible to those who’ve served.”

Key Changes Impacting Veteran Borrowers in 2025:

Following the implementation of the Blue Water Navy Vietnam Veterans Act of 2019, qualified veterans with full entitlement have no VA-imposed loan limits. However, many lenders continue to apply internal overlays, especially on high-balance loans exceeding $1 million. Truss Financial Group is working to minimize such restrictions while clearly communicating updated entitlement rules and lending thresholds.

Highlights of 2025 VA Loan Entitlement Updates:

1. Increased Loan Limits for Most Counties: For 2025, the standard VA loan limit for one-unit properties in most U.S. counties has increased to $806,500, in line with the conforming loan limits set by the Federal Housing Finance Agency (FHFA).

2. High-Cost County Limits Raised: In designated high-cost areas including parts of California, New York, Colorado, and Florida, loan limits for single-family residences have increased to as high as $1,209,750, enhancing veterans' purchasing power.

3. Zero Down Payment with Full Entitlement: Qualified borrowers with full VA entitlement can purchase homes without any down payment even above conforming loan limits, provided they meet lender-specific guidelines and credit/income requirements.

4. 100% Cash-Out Refinancing Options Now Available: Veterans may now qualify for 100% cash-out VA refinance loans up to $1 million or more, depending on eligibility and financial standing. This helps veterans tap into their home equity for renovations, education, debt payoff, or other life needs.

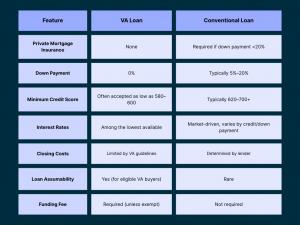

5. No Private Mortgage Insurance (PMI): VA loans continue to offer one of the biggest cost-saving advantages: no PMI, regardless of down payment size. This translates into long-term monthly savings for borrowers.

2025 Trends: VA Lending on the Rise

In 2025, VA lending continues its upward trajectory as more veterans and active-duty service members turn to VA loans for their home financing needs. According to recent data released by the U.S. Department of Veterans Affairs and industry partners:

1. Over 800,000 VA-backed loans were issued in the last 12 months. A 12% year-over-year increase from 2024. This growth reflects both increased awareness of VA benefits and rising home prices that make the VA’s 0% down payment especially appealing.

2. Millennial and Gen Z veterans now represent the largest segment of first-time VA loan users. These younger borrowers are entering the housing market earlier, drawn by flexible credit standards and no-PMI advantages.

3. A report from the Urban Institute estimates VA loan borrowers save between $19,000 and $25,000 over the life of their mortgage compared to conventional borrowers. These savings come from a combination of:

a. Lower average interest rates

b. No private mortgage insurance (PMI)

c. Limited fees and closing costs

4. The Mortgage Bankers Association (MBA) confirms that VA loans in 2025 continue to show the lowest delinquency rates across all major mortgage types, a sign of both borrower reliability and program stability.

These trends not only demonstrate the strength of the VA loan program but also reflect how crucial these products are in expanding homeownership access for those who’ve served. Truss Financial Group simplifies the VA lending process and helps borrowers understand every option available. Veterans can call the toll-free number or submit an Info Request Form online for fast, knowledgeable assistance, 7 days a week.

About Truss Financial Group

Truss Financial Group is a leading independent mortgage lender specializing in helping real estate investors, self-employed borrowers, and veterans access flexible home financing. With over 20 years of experience and strong relationships with major capital partners, Truss delivers personalized service, competitive rates, and solutions tailored to individual borrower needs.

Jason Nichols

Truss Financial Group

+1 888-878-7715

pr@trussfinancialgroup.com

Visit us on social media:

LinkedIn

Instagram

Facebook

YouTube

X

Distribution channels: Banking, Finance & Investment Industry, Business & Economy, Military Industry, Real Estate & Property Management, U.S. Politics

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release