HySights Ratings Launches as World’s First Standardised, Independent Benchmark for New Energy Projects

The first ratings agency for New Energy aims to scale the sector by addressing the uncertainty around project risk and returns.

Despite growing interest in green financing and policy support, New Energy markets have yet to scale: According to the International Energy Agency (IEA), only 4% of projects in low-emission hydrogen and its derivatives reach a Final Investment Decision (FID). One key reason is the lack of typical risk metrics like a market price, leading to uncertainty and a lack of confidence in New Energy investment and offtake decisions.

“Having spoken to over 165 clients across the value chain, we see market stakeholders struggling to assess and compare the risk and returns of different projects at different locations,” says Greg Mittman, HySights CEO, “Evaluating these projects not only demands technical domain expertise, but the nascent New Energy markets also lack pricing information and historical data to guide decision-making. With HySights Ratings, stakeholders can now tell – at a glance – how one project compares to another, and how well it compares against the highest industry standards.”

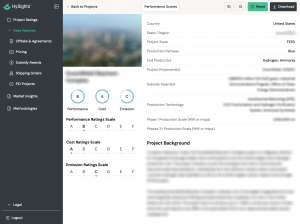

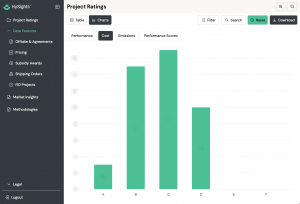

HySights Ratings mark the first time a market intelligence provider has developed an independent, standardised metric to evaluate, compare, and benchmark New Energy projects worldwide. This includes projects across different lifecycle stages (from pre- to post-production) and different pathways (e.g. green and blue). Market stakeholders using HySights Ratings gain insight into a project across three key dimensions: its commercial feasibility, or Performance, the Cost of producing its low-emission molecules, and its Emissions intensity. Each is graded on a six-point scale from A to F.

HySights analysts ensure the accuracy of the data underpinning its ratings through the company’s proprietary vertical AI (AI purpose-built for New Energy applications), capable of processing data from diverse sources: private and public, primary and third-party. The AI further enables access to data in over 130 languages and support for up-to-real-time operational data like emissions monitoring. At present, HySights has analysed data from over 45 million pages of text, including over 3 million translated pages.

Headquartered in Singapore, HySights strategically leverages the city-state’s position as a global energy trading hub, financial, and shipping centre, to support stakeholders across the New Energy value chain in high-value decision-making. They include project developers, offtakers, financiers, equipment suppliers, and upstream renewable energy providers. Says Mittman, "Singapore’s established capabilities in energy trading, sustainable finance, and technology development align perfectly with our mission to accelerate the energy transition."

HySights was incubated under the Singapore Economic Development Board’s (EDB) Corporate Venture Launchpad (CVL) programme, which supports Singapore-based companies with venture creation and startup partnerships. HySights is also supported by global industry leaders IMI plc and Rainmaking APAC.

“The Corporate Venture Launchpad programme is designed to catalyse corporate venture launches like HySights, which is set to bring much needed clarity and accessibility to new energy markets. We look forward to HySights’ continued growth from Singapore, tapping our vibrant local ecosystem of talent, research, and innovation, to drive impact in clean energy and sustainable finance,” said Mr Choo Heng Tong, Executive Vice President, EDB.

The HySights suite of project ratings is available as part of a HySights Project Screener subscription, which includes unique datasets covering the New Energy markets.

Enning Yow

HySights

+65 9010 5861

media@hysights.com

Distribution channels: Banking, Finance & Investment Industry, Business & Economy, Energy Industry, Environment, Shipping, Storage & Logistics

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release