Tokyo Financial Award 2024 Call for Applications from Businesses in Japan and Worldwide

Tokyo Financial Award 2024 recognizes initiatives that create innovation in financial sector, and utilize the power of finance to achieve a sustainable society.

TOKYO, JAPAN, July 8, 2024 /EINPresswire.com/ -- The Tokyo Metropolitan Government, with the aim of making Tokyo an “Innovation and Financial Hub in Asia for Realizing a Sustainable Society,” is making effective use of the newly established “Special Zones for Financial and Asset Management Businesses” to promote initiatives that will position Tokyo as the leading city for sustainable finance, and as the city where global startups are born.

The Tokyo Financial Award 2024 recognizes initiatives that contribute to the creation of innovation in the financial sector, and that utilize the power of finance to achieve a sustainable society. We are inviting applicants for this award, as follows.

1. Outline

The Tokyo Financial Award 2024 comprises the two categories of “Financial Innovation” and “Sustainability.” Applications are accepted for a wide range of initiatives in Japan and overseas.

Financial Innovation Category (Application deadline: Friday August 30, 2024)

This is a business plan contest that recognizes ideas making use of the latest financial technology to offer solutions for the societal issues facing Tokyo residents and society at large. Applications will be judged from the perspective of the innovativeness of the idea, social impact, and feasibility.

Businesses that pass the preliminary screening (written proposal) will be provided with mentoring and additional support to refine their plan (about 15 applicants). Cash prizes will be awarded to the top three applicants in the final screening (presentation). (1st place: 10 million yen; 2nd place: 5 million yen; 3rd place: 3 million yen)

Sustainability Category (Former ESG Investment Category) (Application deadline: Monday September 30, 2024)

This award is presented for initiatives that contribute to the spread of sustainable finance on both the investment side and the business side. Applications will be judged from the perspective of originality and social impact.

Awards will be presented to the top three applicants following a preliminary screening (written proposal) and final screening (presentation). A separate “Green Finance Governor’s Special Award” will be presented for particularly outstanding initiatives in the area of green finance.

(Application Categories)

□ Investment Subcategory (Former ESG Investment Subcategory)

Investment activities that contribute to the realization of a sustainable society

□ Business Subcategory (Former SDGs Subcategory)

Initiatives that leverage sustainable finance to help achieve a sustainable society

2 Business themes open for application

(1) Financial Innovation Category

Statement below contains the detail categories and follow by business themes.

Themes shared across all financial services

・Fostering collaboration within the financial industry, and between financial and non-financial industries (e.g. embedded finance)

・Streamlining and improving convenience of financial asset management (e.g. centralized management of bank accounts, insurance, securities, inheritance)

・Personal advisory services

・Preparing for the era of “the 100-year life” (e.g. financial services that assist those with age-related cognitive decline and initiatives that resolve digital divide)

・Financial services available in multiple languages and currencies (e.g. aimed at international financial transactions, overseas travelers)

・Promotion of financial education (e.g. education regarding asset management and insurance)

・Enhanced interoperability and compatibility between banks (e.g. for ATM usage, account management)

Deposits/withdrawals

・Enhanced convenience of online transactions (e.g. cost reduction, simplifying methods for operations/management)

Payments/remittance

・Greater availability of cashless payments (e.g. expanded options for cashless payments, proliferation of stores that accept cashless payments, enhanced interoperability)

・Enhanced convenience and safety of payment/remittance methods (e.g. cost reduction, expansion of value-added features beyond payment functionality, payments with high safety and convenience standards)

Asset management

・Investment products and services with low barriers to entry (e.g. products that enable investments with small amounts, reduced costs, investment advice)

Insurance

・Simplified insurance procedures (e.g. streamlined processes enabled by technology utilization)

・P2P insurance (insurance sharing)

・Enhancement of ancillary services (e.g. providing pre-insurance and post-insurance services)

Financing

・Easier-to-use financial services (e.g. shorter screening times, lower interest rates)

・Increased financial inclusion (including individuals and corporations that cannot access financial services) (e.g. adopting new credit models)

DX/infrastructure

・Promotion of data utilization (e.g. opening up data, contributing to the financial aspects of resolving issues in projects with a collaborative approach such as with civic tech)

・Streamlined work processes (e.g. streamlining processes such as accounting and verifying IDs)

・Improved security for preventing fraud and other malicious activities (e.g. anti-money laundering and anti-phishing measures)

・Facilitation of carbon credit trading (e.g. building trading platforms, services that enhance transparency of carbon credits)

・Promotion of supply chain finance (e.g. acceleration of fund collection, streamlining of trade procedures)

(2) Sustainability Category

a. Investment Subcategory

Statement below contains the detail categories and follow by business themes.

Proliferation and promotion of sustainable finance

・Proliferation and promotion of sustainable finance and regenerative finance (ReFi)

・Establishing the sustainable finance market and enhancing its trust and transparency

・Utilization of digital technology in sustainable finance

Environment

・Climate change actions

・Natural resources (e.g. water resources, responsible procurement of raw materials, land use, biodiversity)

・Creating environmental market opportunities (e.g. clean technology, renewable energy)

Social

・Human capital (e.g. labor management, promotion of diversity and women’s participation in the workplace, human capital development)

・Health and security & human rights (e.g. product safety, privacy & data security)

・Consideration for stakeholders involved in business operations

Governance

・Enhancement of corporate governance

・Transformation of corporate behavior (e.g. business ethics that benefit society, no track record of fraud, manipulation or corruption, promotion of fair competition)

b. Business Subcategory

・Initiatives that leverage sustainable finance* to help achieve a sustainable society

*Sustainability linked loans, sustainability funds or other similar methods of fundraising

3. Schedule (tentative)

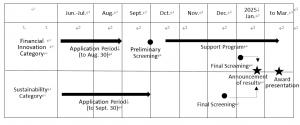

(Please refer to Program Schedule Image)

4. Screening Committee

(Members decided as of the date of this document)

Screening Committee Chair for both Financial Innovation Category and Sustainability Category

YAMAOKA Hiromi

Board Member and Chief Sustainability Officer, Future Corporation

Special Advisor for International Finance, Tokyo Metropolitan Government

Financial Innovation Category Screening committee members

a. OE Kayo President and CEO, Office Libertas

b. UCHIYAMA Tomonori Professor, Graduate School of Management, Tokyo Metropolitan University

c. MASUJIMA Masakazu Partner, Mori Hamada & Matsumoto

Sustainability Category Screening committee members

a. OE Kayo President and CEO, Office Libertas

b. KATO Yasuyuki Professor, Business School, Kyoto University of Advanced Science

c. NEMOTO Naoko Professor, Waseda Business School

Note: Information on the Screening Committee members will be updated on the Tokyo Financial Award 2024 website.

5. How to Apply

Apply through the Tokyo Financial Award website, selecting the desired category.

https://www.finaward.metro.tokyo.lg.jp/en/

Reference: Tokyo Financial Award 2023 Award Winners

【Financial Innovation Category】

1st Place: Toggle G.K. (Japan・US)

・Provides financial planners and others with a chat based service via unique generative AI technology that supports the analysis of client portfolios.

・This new chat service is capable of providing more accurate analysis than existing AI chatbots, enabled by its ability to analyze past economic, financial, and market data.

2nd Place Credit Engine, Inc. (Japan)

・Builds and provides a platform that enables a completely digitalized loan application process for loans guaranteed by guarantee corporations, for all processes undertaken by borrowers, financial institutions, and guarantee corporations.

・Shortens the lead time for loan issuance by streamlining administrative tasks.

3rd Place Inovat Ltd. (UK)

・Provides consumers travelling abroad with a totally digitalized process for obtaining VAT refunds.

・Partners with tax authorities and duty-free stores by providing an API which enables foreign nationals visiting Japan to quickly receive VAT refunds for their purchases by submitting their purchases/receipts using the Inovat app.

【ESG Investment Category】

The Governor’s Special Prize for Green Finance

Kayrros SAS (France)

・Kayrros develops and provides service that can measure and monitor methane emissions of oil and gas businesses by analyzing satellite imagery, and detect such emissions at the source level.

・Data is used for reduction measures by emitters and decision-making by investors engaged in ESG investment.

ANRI, Inc. (Japan)

・A venture capital specializing in long-term investments for startups in the climate tech (technology focusing on addressing impacts of global warming) sector.

・Aims to contribute to decarbonization through supporting the launch and growth of businesses pursuing technology which can take years to realize, including technology for nuclear fusion and battery materials.

Nature Innovation Group, Inc. (Japan)

・Provides the umbrella sharing service “Aikasa.” Users can use the Aikasa app to borrow and return shared umbrellas at locations nationwide.

・Contributes to reducing CO₂ emissions, preserving resources, and combatting waste and marine plastic pollution with a business model designed to cut down the use of disposable plastic umbrellas.

TBM Co., Ltd. (Japan)

・Develops a plastic alternative LIMEX, an innovative new material mainly made from limestone that can be found in various regions around the world, including Japan.

・TBM not only reduces GHG emissions, particularly with its material LIMEX, aims to realize a biodegradability capable of addressing marine plastic pollution.

A2T Secretariat Team

Tokyo Metropolitan Government

a2t-info@deloitte.com

EIN Presswire does not exercise editorial control over third-party content provided, uploaded, published, or distributed by users of EIN Presswire. We are a distributor, not a publisher, of 3rd party content. Such content may contain the views, opinions, statements, offers, and other material of the respective users, suppliers, participants, or authors.