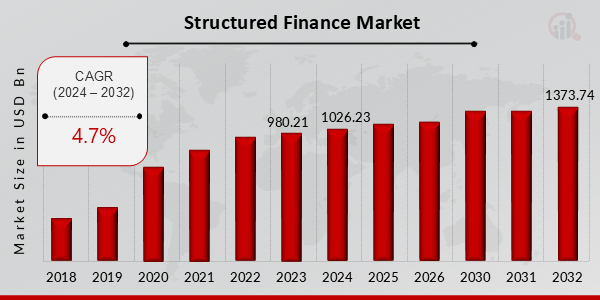

Structured Finance Market Projected for 4.7% CAGR, Reaching 1373.74 Billion by 2032

Structured Finance Market Growth

Structured Finance Market Research Report By, Security Type, Underlying Asset Class, Tranche, Rating, Purpose, Regional

NC, UNITED STATES, March 20, 2025 /EINPresswire.com/ -- The global Structured Finance market has experienced significant growth in recent years and is projected to expand steadily over the coming decade. As per MRFR analysis, the market size was valued at USD 980.21 billion in 2023 and is expected to grow from USD 1026.23 billion in 2024 to an impressive USD 1373.74 billion by 2032, reflecting a steady compound annual growth rate (CAGR) of 4.7% during the forecast period (2024–2032). The market's expansion is primarily driven by increasing demand for risk management solutions, evolving capital markets, and the rising need for liquidity among businesses.

Key Drivers Of Market Growth

Increasing Demand for Risk Management Solutions Structured finance products help businesses manage financial risks by enabling diversified funding sources and optimizing capital structures.

Evolving Capital Markets With global financial markets becoming more complex, structured finance instruments such as asset-backed securities (ABS) and collateralized debt obligations (CDOs) are gaining traction to facilitate capital flow.

Rising Need for Liquidity Among Businesses Companies, especially in sectors such as real estate and banking, increasingly rely on structured finance to enhance liquidity and ensure stability during economic fluctuations.

Regulatory Developments and Compliance Requirements Governments and financial institutions are establishing new frameworks to ensure transparency and stability in structured finance markets, driving adoption.

Download Sample Pages - https://www.marketresearchfuture.com/sample_request/24695

Key Companies in the Structured Finance Market Include

• Barclays

• BNP Paribas

• Nomura Securities

• JPMorgan Chase Co

• Deutsche Bank

• UBS

• Royal Bank of Scotland

• Morgan Stanley

• Credit Suisse

• Bank of America Merrill Lynch

• Goldman Sachs

• Societe Generale

• Citigroup

Browse In-depth Market Research Report: https://www.marketresearchfuture.com/reports/structured-finance-market-24695

Market Segmentation To provide a comprehensive analysis, the Structured Finance market is segmented based on product type, end-user, and region.

1. By Product Type

• Asset-Backed Securities (ABS): Financial instruments backed by a pool of assets such as loans and receivables.

• Collateralized Debt Obligations (CDOs): Structured products comprising various debt instruments for risk distribution.

• Mortgage-Backed Securities (MBS): Bonds secured by real estate mortgages.

• Other Structured Finance Products: Includes credit derivatives and structured investment vehicles.

2. By End-User

• Financial Institutions: Banks and investment firms leveraging structured finance for capital optimization.

• Corporations: Large businesses utilizing structured financial instruments to manage debt and risk.

• Government & Public Sector: Municipalities and government bodies issuing structured securities for funding.

3. By Region

• North America: Leading market due to advanced financial infrastructure and strong regulatory frameworks.

• Europe: Growth driven by increasing adoption of structured finance solutions across banking and real estate sectors.

• Asia-Pacific: Fastest-growing region fueled by economic expansion and rising corporate financing needs.

• Rest of the World (RoW): Emerging markets in Latin America, the Middle East, and Africa contributing to steady market growth.

Procure Complete Research Report Now: https://www.marketresearchfuture.com/checkout?currency=one_user-USD&report_id=24695

The global Structured Finance market is poised for steady expansion, driven by the growing complexity of financial markets, increasing demand for risk mitigation strategies, and regulatory advancements. As businesses and financial institutions continue to seek innovative funding solutions, structured finance is expected to play a crucial role in global capital markets.

Related Report:

B2B Payment Market

https://www.marketresearchfuture.com/reports/b2b-payment-market-22574

Car Insurance Market

https://www.marketresearchfuture.com/reports/car-insurance-market-22576

Cloud Computing Banking Market

https://www.marketresearchfuture.com/reports/cloud-computing-banking-market-22577

Umbrella Insurance Market

https://www.marketresearchfuture.com/reports/umbrella-insurance-market-22580

Cryptocurrency Exchange Platform Market

https://www.marketresearchfuture.com/reports/cryptocurrency-exchange-platform-market-22319

About Market Research Future –

At Market Research Future (MRFR), we enable our customers to unravel the complexity of various industries through our Cooked Research Report (CRR), Half-Cooked Research Reports (HCRR), Raw Research Reports (3R), Continuous-Feed Research (CFR), and Market Research Consulting Services. The MRFR team have a supreme objective to provide the optimum quality market research and intelligence services for our clients. Our market research studies by Components, Application, Logistics and market players for global, regional, and country level market segments enable our clients to see more, know more, and do more, which help to answer all their most important questions.

Market Research Future

Market Research Future

+1 855-661-4441

email us here

Visit us on social media:

Facebook

X

LinkedIn

Distribution channels: Banking, Finance & Investment Industry

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release