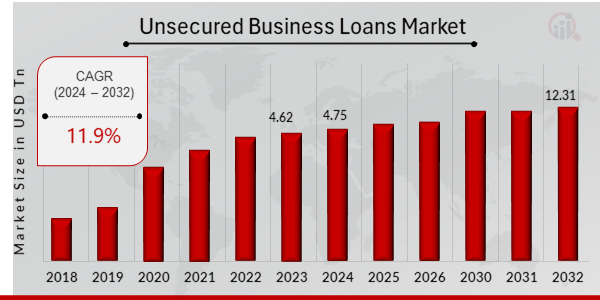

Unsecured Business Loans Market Size Is Likely To Reach a Valuation of Around 12.31 Billion by 2032

Unsecured Business Loans Market Growth

Unsecured Business Loans Market Research Report By, Loan Amount, Purpose, Repayment Term, Collateral, Industry, Regional

MO, UNITED STATES, March 20, 2025 /EINPresswire.com/ -- The global Unsecured Business Loans market has experienced significant growth in recent years and is projected to expand rapidly over the coming decade. In 2023, the market size was valued at USD 4.62 trillion and is expected to grow from USD 4.75 trillion in 2024 to an impressive USD 12.31 trillion by 2032, reflecting a robust compound annual growth rate (CAGR) of 11.9% during the forecast period (2024–2032). The market's expansion is primarily driven by increasing demand for quick business financing, growing adoption of digital lending platforms, and the rising number of small and medium enterprises (SMEs) seeking accessible funding options.

Key Drivers Of Market Growth

Increasing Demand for Quick Business Financing Businesses, particularly SMEs and startups, are increasingly seeking unsecured loans for working capital, expansion, and operational needs without requiring collateral, driving market growth.

Growing Adoption of Digital Lending Platforms The rise of fintech innovations and digital lending solutions has streamlined loan approval processes, reducing processing times and improving accessibility for businesses globally.

Rising Number of Small and Medium Enterprises (SMEs) The rapid growth of SMEs worldwide has led to higher demand for unsecured financing options, as traditional banks often require collateral that many small businesses lack.

Favorable Government Initiatives and Support Programs Governments in various regions are implementing policies and financial assistance programs to support small businesses, further fueling demand for unsecured business loans.

Download Sample Pages - https://www.marketresearchfuture.com/sample_request/24673

Key Companies in the Unsecured Business Loans Market Include

• Biz2Credit

• Fundbox

• Funding Circle

• Upstart

• Kabbage

• Avant

• Lendio

• Credibly

• LendingPoint

• LendingClub

• Kapitus

• BlueVine

• OnDeck

• StreetShares

Browse In-depth Market Research Report: https://www.marketresearchfuture.com/reports/unsecured-business-loans-market-24673

Market Segmentation To provide a comprehensive analysis, the Unsecured Business Loans market is segmented based on loan type, provider, enterprise size, and region.

1. By Loan Type

• Term Loans: Fixed repayment loans for business expansion and operational needs.

• Lines of Credit: Flexible credit solutions allowing businesses to withdraw funds as needed.

• Merchant Cash Advances: Loans based on future credit card sales, ideal for businesses with fluctuating revenue.

• Invoice Financing: Short-term funding based on outstanding invoices.

2. By Provider

• Traditional Banks: Established financial institutions offering unsecured loan products.

• Non-Banking Financial Companies (NBFCs): Alternative lenders providing flexible loan terms.

• Fintech Lenders: Digital platforms offering quick and accessible business financing solutions.

3. By Enterprise Size

• Small Enterprises: High demand for unsecured loans due to limited access to traditional bank financing.

• Medium Enterprises: Increasing adoption of flexible loan solutions for expansion and working capital needs.

• Large Enterprises: Occasional reliance on unsecured loans for short-term liquidity needs.

4. By Region

• North America: Leading market driven by advanced digital lending infrastructure and high SME activity.

• Europe: Growth fueled by increasing fintech adoption and regulatory support for alternative lending.

• Asia-Pacific: Fastest-growing region due to rising entrepreneurial activity and government initiatives supporting SME financing.

• Rest of the World (RoW): Emerging markets in Latin America, the Middle East, and Africa showing steady growth potential.

Procure Complete Research Report Now: https://www.marketresearchfuture.com/checkout?currency=one_user-USD&report_id=24673

The global Unsecured Business Loans market is set for substantial expansion, driven by the increasing need for accessible financing solutions, technological advancements in digital lending, and supportive regulatory frameworks. As businesses continue to prioritize financial agility and operational growth, the demand for unsecured business loans is expected to rise significantly, shaping the future of business financing worldwide.

Related Report:

Online Powersports Market

Real Estate Management Solution Market

About Market Research Future –

At Market Research Future (MRFR), we enable our customers to unravel the complexity of various industries through our Cooked Research Report (CRR), Half-Cooked Research Reports (HCRR), Raw Research Reports (3R), Continuous-Feed Research (CFR), and Market Research Consulting Services. The MRFR team have a supreme objective to provide the optimum quality market research and intelligence services for our clients. Our market research studies by Components, Application, Logistics and market players for global, regional, and country level market segments enable our clients to see more, know more, and do more, which help to answer all their most important questions.

Market Research Future

Market Research Future

+1 855-661-4441

email us here

Visit us on social media:

Facebook

X

LinkedIn

Distribution channels: Banking, Finance & Investment Industry

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release