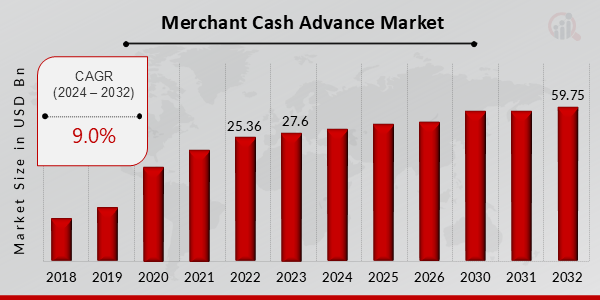

Merchant Cash Advance Market 2032 Trends: Expected to Grow at a CAGR of 9.0%

Merchant Cash Advance Market Trends

Merchant Cash Advance Market Research Report By, Loan Amount, Industries Served, Advance Term, Repayment Frequency, Repayment Mechanism, Regional

RI, UNITED STATES, March 18, 2025 /EINPresswire.com/ -- The global Merchant Cash Advance (MCA) market has witnessed significant growth in recent years and is expected to expand further in the coming decade. In 2022, the market size was valued at USD 25.36 billion and is projected to grow from USD 27.6 billion in 2023 to an impressive USD 59.75 billion by 2032, reflecting a robust compound annual growth rate (CAGR) of 9.0% during the forecast period (2024–2032). The growth is primarily driven by increasing demand for alternative financing solutions, the rise of small and medium-sized enterprises (SMEs), and advancements in fintech lending platforms.

Key Drivers of Market Growth

Growing Demand for Alternative Financing

Traditional lending institutions often impose strict credit requirements, making it difficult for small businesses to secure loans. Merchant cash advances provide a flexible financing option with quick approvals and minimal collateral requirements, fueling market expansion.

Rise of Small and Medium-Sized Enterprises (SMEs)

The increasing number of SMEs across various industries is driving the demand for quick and accessible financing. MCAs help businesses manage cash flow, invest in growth opportunities, and cover operational expenses, thereby contributing to market growth.

Advancements in Fintech and Digital Lending

The integration of artificial intelligence (AI), big data, and blockchain in financial services has revolutionized the MCA market. Digital lending platforms streamline application processes, improve risk assessment, and enhance customer experience, boosting adoption rates.

Expanding E-Commerce and Retail Sector

The growing e-commerce industry has increased the need for short-term funding solutions to manage inventory, marketing, and operational costs. MCA providers cater to this demand, driving market expansion.

Download Sample Pages - https://www.marketresearchfuture.com/sample_request/24003

Key Companies in the Merchant Cash Advance Market Include

• Rapid Finance

• CAN Capital

• Credibly

• National Funding

• Fora Financial

• PayPal Working Capital

• Square Capital

• Fundbox

• Lendio

• Kabbage (American Express)

• Breakout Capital

• Reliant Funding

• BFS Capital

• Bitty Advance

• OnDeck Capital

Browse In-depth Market Research Report: https://www.marketresearchfuture.com/reports/merchant-cash-advance-market-24003

Market Segmentation

To provide a comprehensive analysis, the Merchant Cash Advance market is segmented based on business size, provider type, industry vertical, and region.

1. By Business Size

o Small Businesses: Major adopters of MCAs due to limited access to traditional credit.

o Medium-Sized Businesses: Increasing adoption for expansion and operational funding.

2. By Provider Type

o Banks & Financial Institutions: Traditional lenders integrating MCA services.

o Non-Banking Financial Companies (NBFCs): Alternative lenders providing quick funding solutions.

o Online Lending Platforms: Fintech companies offering digital-first MCA solutions.

3. By Industry Vertical

o Retail & E-Commerce: High demand due to inventory and marketing expenses.

o Healthcare: Growing adoption for clinic expansion and equipment purchases.

o Hospitality: Hotels and restaurants leveraging MCA for operational needs.

o Manufacturing: Businesses using MCA for machinery and production costs.

o Transportation & Logistics: Funding for fleet maintenance and fuel expenses.

4. By Region

o North America: Leading market due to strong SME presence and fintech advancements.

o Europe: Growth driven by increased adoption of alternative lending solutions.

o Asia-Pacific: Fastest-growing region, fueled by rapid digitization and SME expansion.

o Rest of the World (RoW): Emerging opportunities in Latin America, the Middle East, and Africa due to rising entrepreneurship.

Procure Complete Research Report Now: https://www.marketresearchfuture.com/checkout?currency=one_user-USD&report_id=24003

The global Merchant Cash Advance market is poised for substantial growth, driven by increasing demand for fast and flexible financing solutions. As businesses continue to seek alternative funding options, fintech innovations and digital lending platforms are expected to shape the future of the industry. With expanding opportunities across various sectors and regions, the MCA market is set to play a crucial role in global business financing.

Related Report:

Loan Management Software Market

Machine Learning in Banking Market

About Market Research Future –

At Market Research Future (MRFR), we enable our customers to unravel the complexity of various industries through our Cooked Research Report (CRR), Half-Cooked Research Reports (HCRR), Raw Research Reports (3R), Continuous-Feed Research (CFR), and Market Research Consulting Services. The MRFR team have a supreme objective to provide the optimum quality market research and intelligence services for our clients. Our market research studies by Components, Application, Logistics and market players for global, regional, and country level market segments enable our clients to see more, know more, and do more, which help to answer all their most important questions.

Market Research Future

Market Research Future

+1 855-661-4441

email us here

Visit us on social media:

Facebook

X

LinkedIn

Distribution channels: Banking, Finance & Investment Industry

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release