Debit Card Market to Expand from 188.18 Billion by 2034 | CAGR of 5.50%

Debit Card Market Share

Debit Card Market Research Report By, Usage, Network, Payment Type, Technology, Regional

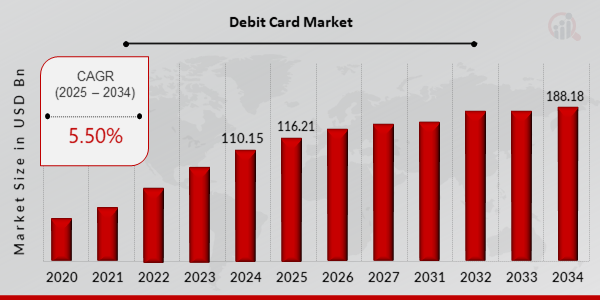

DC, UNITED STATES, March 18, 2025 /EINPresswire.com/ -- The global Debit Card market has been witnessing steady growth and is poised for further expansion in the coming years. In 2024, the market size was valued at USD 110.15 billion and is expected to grow from USD 116.21 billion in 2025 to an impressive USD 188.18 billion by 2034, reflecting a compound annual growth rate (CAGR) of 5.50% during the forecast period (2025–2034). This growth is primarily driven by increasing digital payment adoption, rising financial inclusion, and technological advancements in the banking sector.

Key Drivers of Market Growth

Increasing Digital Payment Adoption

The rapid shift toward cashless transactions and contactless payments has significantly boosted the usage of debit cards. Consumers are increasingly preferring debit cards over cash for everyday purchases due to their convenience and security.

Rising Financial Inclusion

Governments and financial institutions worldwide are actively promoting financial inclusion initiatives, leading to a surge in debit card issuance, particularly in emerging markets. Programs aimed at providing banking access to the unbanked population are fueling market expansion.

Technological Advancements in Banking

Innovations such as Near Field Communication (NFC), biometric authentication, and blockchain technology are enhancing the security and functionality of debit cards. These advancements are increasing consumer confidence and driving market growth.

Growing E-Commerce Transactions

The booming e-commerce sector is propelling the demand for debit cards as more consumers opt for secure digital payments when shopping online. The ease of linking debit cards to digital wallets is further contributing to market growth.

Download Sample Pages - https://www.marketresearchfuture.com/sample_request/23925

Key Companies in the Debit Card Market Include

• JCB International

• Payoneer

• UnionPay International

• China UnionPay

• Visa International

• Mastercard

• PayPal

• GoodData Corporation

• eftpos

• Discover Financial

• Hypercom

• Diners Club International

• American Express

• Interac

Browse In-depth Market Research Report: https://www.marketresearchfuture.com/reports/debit-card-market-23925

Market Segmentation

To provide a comprehensive analysis, the Debit Card market is segmented based on card type, usage, end-user, and region.

1. By Card Type

o Standard Debit Cards: Basic bank-issued cards for everyday transactions.

o Contactless Debit Cards: Enabled with NFC technology for fast and secure payments.

o Prepaid Debit Cards: Reloadable cards used for budgeting and financial control.

o Virtual Debit Cards: Digital-only cards used for online transactions.

2. By Usage

o ATM Transactions: Cash withdrawals and balance inquiries.

o Point of Sale (POS) Transactions: In-store purchases and retail payments.

o Online Payments: E-commerce transactions and digital subscriptions.

o International Transactions: Cross-border payments and travel-related purchases.

3. By End-User

o Individuals: Personal banking customers utilizing debit cards for daily expenses.

o Businesses: Corporate debit cards issued for employee and operational expenses.

o Government Institutions: Cards issued for social welfare programs and financial aid distribution.

4. By Region

o North America: Leading market due to high banking penetration and digital payment adoption.

o Europe: Strong growth driven by regulatory support for cashless transactions.

o Asia-Pacific: Fastest-growing region, fueled by financial inclusion initiatives and smartphone penetration.

o Rest of the World (RoW): Emerging opportunities in Latin America, the Middle East, and Africa with expanding banking infrastructure.

Procure Complete Research Report Now: https://www.marketresearchfuture.com/checkout?currency=one_user-USD&report_id=23925

The global Debit Card market is set to experience substantial growth, driven by increasing digital transactions, enhanced banking technologies, and expanding financial inclusion. As consumers and businesses continue to prioritize secure and efficient payment methods, the demand for debit cards is expected to surge. With evolving regulatory landscapes and technological innovations, the market is poised for long-term expansion.

Related Report:

Financial Calculator Market

https://www.marketresearchfuture.com/reports/financial-calculator-market-33108

Financial Fraud Detection Software Market

https://www.marketresearchfuture.com/reports/financial-fraud-detection-software-market-33148

Financial Protection Market

https://www.marketresearchfuture.com/reports/financial-protection-market-33169

Fingerprint Payment Market

https://www.marketresearchfuture.com/reports/fingerprint-payment-market-33189

Foreign Exchange Service Market

https://www.marketresearchfuture.com/reports/foreign-exchange-service-market-32927

About Market Research Future –

At Market Research Future (MRFR), we enable our customers to unravel the complexity of various industries through our Cooked Research Report (CRR), Half-Cooked Research Reports (HCRR), Raw Research Reports (3R), Continuous-Feed Research (CFR), and Market Research Consulting Services. The MRFR team have a supreme objective to provide the optimum quality market research and intelligence services for our clients. Our market research studies by Components, Application, Logistics and market players for global, regional, and country level market segments enable our clients to see more, know more, and do more, which help to answer all their most important questions.

Market Research Future

Market Research Future

+1 855-661-4441

email us here

Visit us on social media:

Facebook

X

LinkedIn

Distribution channels: Banking, Finance & Investment Industry

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release