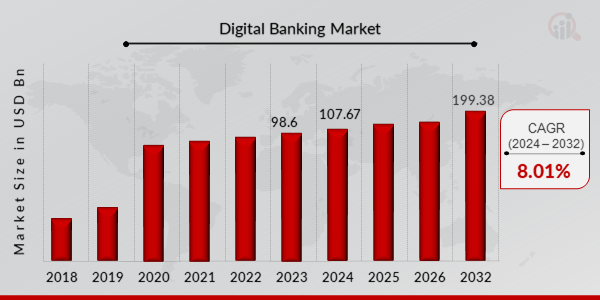

Digital Banking Market Anticipated to Attain 199.38 billion By 2032, at 8.01% CAGR

Digital Banking Market Trends

Digital Banking Market Research Report Information By, Services, Deployment Type, Technology, Industries, and Region

DC, UNITED STATES, March 10, 2025 /EINPresswire.com/ -- Digital Banking Market Size was estimated at USD 98.6 billion in 2023. The Digital Banking Industry is projected to grow from USD 107.67 billion in 2024 to USD 199.38 billion by 2032, exhibiting a compound annual growth rate (CAGR) of 8.01% during the forecast period (2024 - 2032).

Key Drivers of Market Growth

Rising Adoption of Mobile and Online Banking

The increasing preference for mobile and internet banking services is driving the expansion of the digital banking market.

Advancements in Financial Technology (FinTech)

Technological innovations, including AI-driven banking solutions and blockchain technology, are enhancing digital banking capabilities.

Growing Demand for Seamless Customer Experience

Consumers seek faster, more convenient, and personalized banking services, leading banks to invest in digital transformation.

Regulatory Support for Digital Banking

Government initiatives and regulatory policies supporting digital financial services are fostering market growth.

Increased Cybersecurity Measures

Rising concerns over data security and fraud prevention have prompted banks to implement robust cybersecurity frameworks, boosting consumer confidence in digital banking.

Download Sample Pages – https://www.marketresearchfuture.com/sample_request/1986

Key Companies in the Digital Banking Market Include:

• SAP

• Misys

• Q2

• Kony

• Infosys

• Urban FT

• Backbase

• Technisys

Browse In-Depth Market Research Report – https://www.marketresearchfuture.com/reports/digital-banking-market-1986

Market Segmentation

To provide a comprehensive analysis, the Digital Banking Market is segmented based on service type, banking mode, deployment model, and region.

1. By Service Type

• Retail Banking: Personal banking services including savings, loans, and online transactions.

• Corporate Banking: Digital solutions for business banking, credit, and investment services.

2. By Banking Mode

• Online Banking: Web-based banking platforms offering digital financial services.

• Mobile Banking: Smartphone applications providing on-the-go banking solutions.

3. By Deployment Model

• On-Premises: Banks managing in-house digital banking infrastructure.

• Cloud-Based: Scalable digital banking solutions leveraging cloud computing.

4. By Region

• North America: Leading market due to early digital banking adoption and technological advancements.

• Europe: Strong growth fueled by open banking regulations and digital transformation initiatives.

• Asia-Pacific: Rapid expansion driven by increasing internet penetration and mobile banking adoption.

• Rest of the World (RoW): Emerging markets with growing fintech investments.

Procure Complete Research Report Now: https://www.marketresearchfuture.com/checkout?currency=one_user-USD&report_id=1986

The global Digital Banking Market is experiencing significant growth, driven by advancements in financial technology, customer demand for seamless banking experiences, and regulatory support. As banks continue to innovate, the adoption of digital banking services will accelerate, shaping the future of the financial industry.

Related Report –

construction equipment finance market

https://www.marketresearchfuture.com/reports/construction-equipment-finance-market-28892

consumer finance market

https://www.marketresearchfuture.com/reports/consumer-finance-market-24293

convenience stores market

https://www.marketresearchfuture.com/reports/convenience-stores-market-22842

credit insurance market

https://www.marketresearchfuture.com/reports/credit-insurance-market-24055

crime insurance market

https://www.marketresearchfuture.com/reports/crime-insurance-market-23993

About Market Research Future –

At Market Research Future (MRFR), we enable our customers to unravel the complexity of various industries through our Cooked Research Report (CRR), Half-Cooked Research Reports (HCRR), Raw Research Reports (3R), Continuous-Feed Research (CFR), and Market Research Consulting Services. The MRFR team have a supreme objective to provide the optimum quality market research and intelligence services for our clients. Our market research studies by Components, Application, Logistics and market players for global, regional, and country level market segments enable our clients to see more, know more, and do more, which help to answer all their most important questions.

Market Research Future

Market Research Future

+1 855-661-4441

email us here

Visit us on social media:

Facebook

X

LinkedIn

Distribution channels: Banking, Finance & Investment Industry

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release