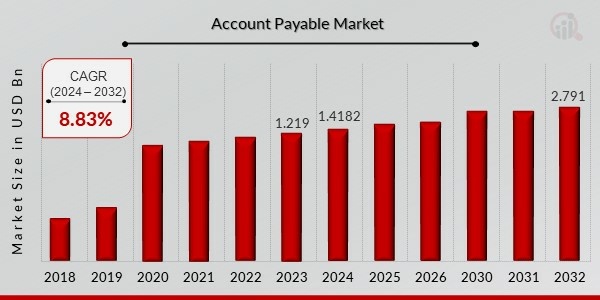

Account Payable Market 2032 Trends: Expected to Grow at a CAGR of 8.83%

Account Payable Market Trends

Account Payable Market Research Report Information By, Component, Deployment, Enterprise Size, Vertical and Region

NM, UNITED STATES, March 10, 2025 /EINPresswire.com/ -- The Account Payable Market size is projected to grow from USD 1.41 billion in 2024 to USD 2.79 billion by 2032, exhibiting a compound annual growth rate (CAGR) of 8.83% during the forecast period (2024 - 2032). Additionally, the market size for Account Payable was valued at USD 1.21 billion in 2023.

Key Drivers of Market Growth

Increasing Adoption of Automation in Financial Processes

The growing need for efficiency and accuracy in financial transactions is driving the adoption of automated account payable solutions. Businesses are leveraging AI-driven and cloud-based technologies to streamline invoice processing and payment approvals.

Rising Demand for Digital Payment Solutions

The shift towards digital payment methods and the integration of electronic invoicing (e-invoicing) are enhancing the efficiency of accounts payable processes, reducing errors, and improving overall financial management.

Regulatory Compliance and Risk Management

Stringent financial regulations and compliance requirements are prompting organizations to adopt accounts payable solutions that ensure transparency, fraud detection, and adherence to financial standards.

Cost Reduction and Operational Efficiency

Automated accounts payable solutions reduce manual intervention, lower processing costs, and improve overall workflow efficiency. Companies are increasingly investing in AP automation to enhance financial control and optimize cash flow management.

Integration with Enterprise Resource Planning (ERP) Systems

Seamless integration with ERP and financial management systems enables real-time tracking of invoices, payments, and cash flow, driving widespread adoption across industries.

Download Sample Pages – https://www.marketresearchfuture.com/sample_request/8683

Key Companies in the Account Payable Market Include:

• Sage Group plc (UK)

• OSAS (US)

• Esker (France)

• AvidXchange (US)

• Newgen Software Technologies Limited (India)

• SutiSoft Inc. (US)

• Invoicera (India)

• SAP (Germany)

• Comarch (Poland)

• FIS (US)

• Vanguard Systems (US)

• Zycus Inc.(US)

• Tipalti, Inc. (US)

• Bottomline Technologies (de), Inc. (US)

• Beanworks (Canada)

Browse In-Depth Market Research Report – https://www.marketresearchfuture.com/reports/account-payable-market-8683

Market Segmentation

To provide a comprehensive analysis, the Account Payable Market is segmented based on component, deployment mode, enterprise size, industry vertical, and region.

1. By Component

• Solutions: Invoice automation, payment processing, fraud detection, and reporting.

• Services: Implementation, consulting, and support services.

2. By Deployment Mode

• On-Premises: Preferred by large enterprises for greater control and security.

• Cloud-Based: Offers scalability, flexibility, and cost-effectiveness for businesses of all sizes.

3. By Enterprise Size

• Large Enterprises: High adoption of automation to enhance financial efficiency.

• Small & Medium Enterprises (SMEs): Increasing demand for cost-effective AP solutions.

4. By Industry Vertical

• Banking, Financial Services & Insurance (BFSI): High demand for compliance-driven AP automation.

• Retail & E-Commerce: Streamlining supplier payments and invoice management.

• Healthcare: Enhancing financial workflows for medical billing and insurance claims.

• Manufacturing: Automating procurement and supplier payments.

• IT & Telecom: Managing vendor payments efficiently.

5. By Region

• North America: Leading market driven by advanced financial automation and regulatory compliance.

• Europe: Strong adoption of AP automation due to digital transformation initiatives.

• Asia-Pacific: Rapid growth fueled by increasing digital payment adoption in emerging economies.

• Rest of the World (RoW): Gradual adoption with a focus on cost-saving solutions.

Procure Complete Research Report Now: https://www.marketresearchfuture.com/checkout?currency=one_user-USD&report_id=8683

The global Account Payable Market is expected to witness steady growth due to the increasing demand for automation, compliance-driven financial solutions, and enhanced operational efficiency. Businesses must continue investing in AP automation to streamline financial processes, reduce errors, and improve overall cash flow management. The future of the market will be driven by digital transformation and integration with AI-driven financial technologies.

Related Report –

capital exchange ecosystem market

car insurance aggregators market

About Market Research Future –

At Market Research Future (MRFR), we enable our customers to unravel the complexity of various industries through our Cooked Research Report (CRR), Half-Cooked Research Reports (HCRR), Raw Research Reports (3R), Continuous-Feed Research (CFR), and Market Research Consulting Services. The MRFR team have a supreme objective to provide the optimum quality market research and intelligence services for our clients. Our market research studies by Components, Application, Logistics and market players for global, regional, and country level market segments enable our clients to see more, know more, and do more, which help to answer all their most important questions.

Market Research Future

Market Research Future

+1 855-661-4441

email us here

Visit us on social media:

Facebook

X

LinkedIn

Distribution channels: Banking, Finance & Investment Industry

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release