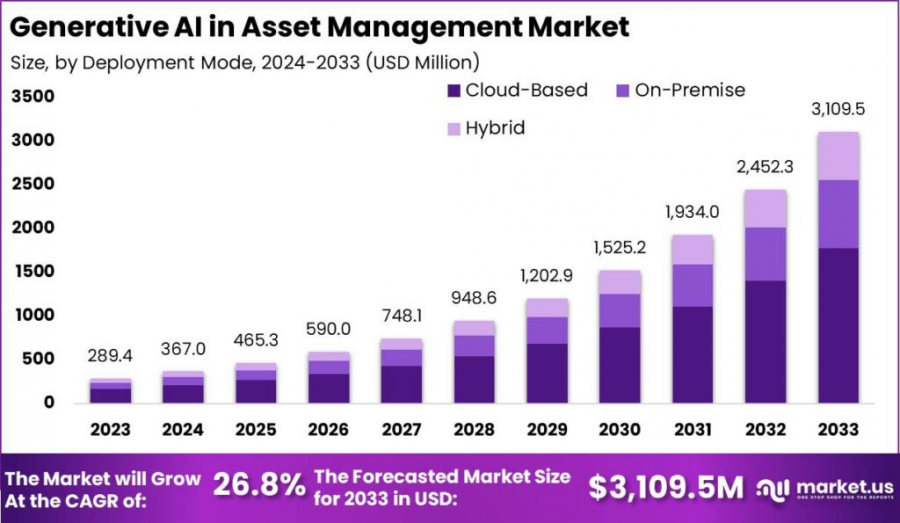

Generative AI in Asset Management Market Grows Industries By USD 3,109.5 Million by 2033, Region at 47.6% share

In 2023, North America held a dominant market position, capturing more than a 47.6% share, holding USD 137.7 Million in revenue...

NEW YORK, NY, UNITED STATES, January 27, 2025 /EINPresswire.com/ -- The Global Generative AI in Asset Management Market is poised for remarkable growth, with projections indicating it will reach USD 3,109.5 million by 2033, up from USD 289.4 million in 2023, growing at a CAGR of 26.8% during the forecast period from 2024 to 2033. This growth is driven by several major factors:

Technological Advancements: The increasing sophistication of machine learning (ML) and natural language processing (NLP) algorithms has allowed generative AI to enhance portfolio management, risk analysis, and automated trading systems. These advancements are enabling asset managers to better predict market trends, automate decision-making, and optimize asset allocation.

Market Demand: As financial markets become more complex and data-driven, there is a growing demand for AI-driven tools that can provide real-time insights, improve decision-making, and reduce human error. Asset managers are increasingly turning to generative AI to improve efficiency, accuracy, and profitability.

🔴 𝐂𝐥𝐢𝐜𝐤 𝐇𝐞𝐫𝐞 𝐓𝐨 𝐕𝐢𝐞𝐰 𝐏𝐃𝐅 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐒𝐚𝐦𝐩𝐥𝐞 @ https://market.us/report/generative-ai-in-asset-management-market/request-sample/

Cost Efficiency: AI tools enable automation in routine tasks such as portfolio balancing and asset allocation, allowing asset managers to reduce operational costs and focus on more strategic decision-making.

Regional Growth: North America leads the market, capturing over 47.6% of the share in 2023, owing to its advanced technological infrastructure and a high rate of adoption among financial institutions.

According to a report by PWC, platforms in asset management are expected to handle nearly $6 trillion in assets by 2027, nearly doubling from $3.1 trillion in 2022. This surge in asset management underscores the growing role of technology in the sector. Generative AI adoption is seeing significant momentum, as revealed by a recent KPMG survey.

In March, 50% of executives indicated they were likely to allocate budgets for generative AI within the next six to twelve months. By June, the trend intensified, with 40% of executives planning to boost their generative AI investments by 50% to 99%. Moreover, 45% of respondents expressed plans to double their budgets for generative AI initiatives, reflecting the increasing confidence in the technology's potential to drive efficiencies and innovation within asset management.

🔴 𝐇𝐮𝐫𝐫𝐲 𝐄𝐱𝐜𝐥𝐮𝐬𝐢𝐯𝐞 𝐃𝐢𝐬𝐜𝐨𝐮𝐧𝐭 𝐅𝐨𝐫 𝐋𝐢𝐦𝐢𝐭𝐞𝐝 𝐏𝐞𝐫𝐢𝐨𝐝 𝐎𝐧𝐥𝐲 @ https://market.us/purchase-report/?report_id=136697

Key Takeaways

Cloud-Based Solutions: In 2023, cloud-based solutions dominated the Generative AI in the Asset Management market, holding 57.3% of the global share. Their scalability and cost-effectiveness continue to drive widespread adoption across various industries.

Portfolio Management: AI-powered portfolio management solutions captured 31.6% of the market share in 2023, highlighting the significant role AI plays in optimizing investment strategies and enhancing returns.

Asset Management Firms: These firms represented the largest end-user group, holding 48.7% of the market share in 2023, using generative AI to improve decision-making and streamline operations for better efficiency.

Regional Leadership: North America was the leading region, holding more than 47.6% of the global market share in 2023. The region’s strong technological infrastructure and early adoption of AI-driven tools contributed to its dominance.

Market Growth: According to UBS, wealth and asset growth increased from 3.7% annually between 2000 and 2010 to 6.3% between 2010 and 2023, driving demand for advanced asset management solutions, with AI at the forefront.

Transformative Potential: Forbes reports that generative AI could increase productivity in the banking sector by up to 5% and reduce global expenses by $300 billion, positioning AI as a game-changer for financial services.

🔴 𝐕𝐢𝐞𝐰 𝐏𝐃𝐅 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐒𝐚𝐦𝐩𝐥𝐞 @ https://market.us/report/generative-ai-in-asset-management-market/request-sample/

Experts Review

The Generative AI in Asset Management Market is poised for substantial growth, fueled by both government incentives and technological innovations. Governments across the globe are increasingly recognizing the transformative potential of AI and offering incentives, such as tax breaks and funding for AI-related projects. These initiatives are encouraging asset management firms to invest in generative AI tools that automate decision-making and enhance operational efficiency.

Technological advancements, particularly in machine learning and natural language processing, are revolutionizing the way asset managers process vast amounts of financial data. These innovations enable the development of more accurate predictive models for portfolio optimization and risk management.

There are significant investment opportunities in AI-powered asset management platforms, particularly in markets such as North America and Europe, where demand for these solutions is rising rapidly. However, there are also risks, including data privacy concerns and the challenge of integrating AI with existing financial systems.

Consumer awareness is increasing as investors seek more personalized and automated investment solutions. Generative AI allows firms to offer tailored recommendations and insights, enhancing the client experience. However, the evolving regulatory environment around AI presents challenges, as firms must ensure their AI solutions comply with stringent data protection laws and avoid potential biases in decision-making.

Overall, generative AI is transforming asset management, offering significant opportunities while requiring careful attention to regulatory and ethical considerations.

🔴 𝐆𝐞𝐭 𝐭𝐡𝐞 𝐅𝐮𝐥𝐥 𝐑𝐞𝐩𝐨𝐫𝐭 𝐚𝐭 𝐄𝐱𝐜𝐥𝐮𝐬𝐢𝐯𝐞 𝐃𝐢𝐬𝐜𝐨𝐮𝐧𝐭 (𝐋𝐢𝐦𝐢𝐭𝐞𝐝 𝐏𝐞𝐫𝐢𝐨𝐝 𝐎𝐧𝐥𝐲) @ https://market.us/purchase-report/?report_id=136697

Report Segmentation

The Generative AI in Asset Management Market is segmented across several key dimensions, including deployment mode, type, application, and end-user industry.

Deployment Mode: The market is divided into cloud-based and on-premise solutions. Cloud-based deployment leads the market, capturing a larger share due to its scalability, flexibility, and cost-effectiveness. It allows asset management firms to leverage AI tools without the need for heavy infrastructure investments. On-premise solutions, although smaller in share, are preferred by organizations that prioritize control over their data and operations.

Type: The market is segmented into text-to-image generation, image-to-image generation, music generation, video generation, and 3D modeling and animation. Among these, text-to-image generation has emerged as a dominant type, driven by its application in marketing and personalized media content.

Application: Key applications of generative AI in asset management include portfolio management, risk analysis, and automated trading. Portfolio management accounts for the largest share as AI helps asset managers optimize investment strategies and automate asset allocation, leading to improved returns.

End-User Industry: The market primarily serves asset management firms, banks, and investment firms. Asset management firms are the largest segment, leveraging generative AI to enhance decision-making, improve client services, and streamline operations.

Key Market Segments

By Deployment Model

Cloud-Based

On-Premise

Hybrid

By Application

Portfolio Management

Risk Management

Client Engagement & Personalization

Research and Analysis

Others

By End-User

Asset Management Firms

Banks and Financial Institutions

Insurance Companies

Corporate Firms

Key Player Analysis

Key players in the Generative AI in the Asset Management Market include BlackRock, Goldman Sachs, JPMorgan Chase, IBM, and Microsoft. These firms are leveraging generative AI technologies to optimize asset management operations. BlackRock uses AI for quantitative research and portfolio management, significantly enhancing decision-making processes. Goldman Sachs and JPMorgan Chase are integrating AI-driven tools into their trading and risk management systems to improve market predictions and portfolio optimization.

IBM offers AI solutions such as Watson Financial Services, which assist in risk analysis and automation in asset management. Microsoft provides Azure AI, a cloud-based platform that allows financial institutions to integrate generative AI into their systems for enhanced automation and predictive analysis. These market leaders continue to push the boundaries of AI’s potential in asset management, driving innovations that enhance efficiency, reduce costs, and improve investment strategies.

Top Key Players in the Market

BlackRock

Numerai

Kensho

Two Sigma

Vanguard

State Street

Aptiv

Qplum

XTX Markets

QuantConnect

ServiceNow

SAS

Other Key Players

Recent Developments

In recent developments, BlackRock has advanced its AI capabilities by incorporating deep learning models for portfolio optimization and risk management. Similarly, JPMorgan Chase has introduced AI-powered tools to streamline client engagement, enhance decision-making, and automate back-office operations.

Goldman Sachs is leveraging AI models for real-time trading and risk analysis, significantly improving asset allocation strategies. Microsoft’s Azure AI platform is gaining traction, allowing asset management firms to integrate AI solutions into their operations with increased efficiency and scalability. Furthermore, the adoption of AI-driven platforms in asset management has accelerated in response to growing market complexities and the need for faster decision-making.

Conclusion

The Generative AI in Asset Management Market is rapidly growing, driven by technological advancements and increasing demand for automation in financial operations. Leading players in the market are innovating with AI solutions that enhance portfolio management, risk analysis, and trading strategies. As AI adoption continues to rise, asset management firms will benefit from improved decision-making, operational efficiency, and enhanced customer service. The market is set for substantial growth as AI tools become integral to financial services.

➤ 𝐄𝐱𝐩𝐥𝐨𝐫𝐞 𝐎𝐭𝐡𝐞𝐫 𝐈𝐧𝐭𝐞𝐫𝐞𝐬𝐭𝐞𝐝 𝐓𝐨𝐩𝐢𝐜𝐬

Edge Data Center Market - https://market.us/report/edge-data-center-market/

Same Day Delivery Market - https://market.us/report/same-day-delivery-market/

Drone Package Delivery Market - https://market.us/report/drone-package-delivery-market/

Telecom Cloud Market - https://market.us/report/telecom-cloud-market/

Critical Illness Insurance Market, By Disease (Cancer, Heart Attack, Stroke, and Other Applications), By Premium Mode (Monthly, Quarterly, Half Yearly, and Yearly), By Type (Individual and Fami Market - https://market.us/report/critical-illness-insurance-market/

Point of Sale Software Market - https://market.us/report/point-of-sale-software-market/

Revenue Cycle Management Market - https://market.us/report/revenue-cycle-management-market/

Antivirus Software Market - https://market.us/report/antivirus-software-market/

Email Marketing Market - https://market.us/report/email-marketing-market/

Commercial Printing Market - https://market.us/report/commercial-printing-market/

Lawrence John

Prudour

+91 91308 55334

Lawrence@prudour.com

Visit us on social media:

Facebook

LinkedIn

Distribution channels: Banking, Finance & Investment Industry

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release