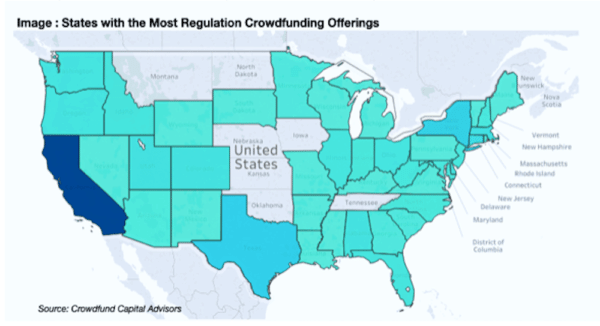

The first Fiscal Year of Regulation Crowdfunding has come to an end and our data continues to deliver valuable information for investors, founders and government officials. Overwhelmingly, California has taken the early lead in Regulation Crowdfunding from both an entrepreneur (aka issuer) and investor point-of-view. Currently, Texas is in second place and New York is third. If you are an entrepreneur in any of these states, you have an increased chance that potential investors in your network/community may be familiar with Regulation Crowdfunding already. States including Idaho, Connecticut, Massachusetts, Utah, Alabama, Colorado and West Virginia also have higher than average number of backers which may indicate a warming of those markets to Regulation Crowdfunding over the last 12 months.

Which States Have Built an Early Lead in Number of Campaigns?

As the image above shows, as of June 30th California leads. Of the 399 total offerings across the USA, California had 34% (134) of the total. Behind that is New York with 30 offerings and Texas with 29. The fact that California is 447% higher in the number of offerings than New York shows that there is much more awareness about Regulation Crowdfunding in California than anywhere else.

Digging a little deeper, the data shows us that almost 50% of the companies were based in greater Silicon Valley area – (an area replete with Angel Investors). This might be due to a few reasons: a) The ingrained startup culture in the region with entrepreneurs flocking to the area b) Since there are many startups in Silicon Valley they are actively competing for investor dollars and c) Because VCs are now requiring more “social proof” of a company’s business model, companies are turning to Regulation Crowdfunding as that evidence.

Digging a little deeper, the data shows us that almost 50% of the companies were based in greater Silicon Valley area – (an area replete with Angel Investors). This might be due to a few reasons: a) The ingrained startup culture in the region with entrepreneurs flocking to the area b) Since there are many startups in Silicon Valley they are actively competing for investor dollars and c) Because VCs are now requiring more “social proof” of a company’s business model, companies are turning to Regulation Crowdfunding as that evidence.

Texas demonstrates similar city concentration effects within the state because the clear majority of the offerings are split between Austin and Houston. (A full breakdown by City, State and Industry can be found here). Again, these are 2 cities in Texas that have significant experience in Angel investing/risk capital deployment. Austin has more experience with Angel investment in technology companies, and Houston has significant experience in deploying risk capital for early stage oil and gas ventures.

Which States Lead in Dollars Raised?

The top 4 states in total funds raised via Regulation Crowdfunding are:

- California ($20.3 Million)

- Texas ($6 Million)

- Massachusetts ($3.5 Million)

- New York ($2.7 Million)

While California may lead in the number of offerings and the overall dollars committed they do not lead when it comes to the average amount raised by campaign. If we look at data from campaigns that closed and exceeded their Minimum Funding Target, (and we require at least 5 successes in a State to add some credibility to the averages) we find that Massachusetts leads the way with $445,000 on average (n=6), followed Texas $312,000 (n=15), New York $278,000 (n=6) and then California $255,000 (n=54). The average of all successfully funded campaigns for the first fiscal year was $302,000. The takeaway here: In the first year, entrepreneurs in Massachusetts and Texas raised more per campaign than the national average. A key reason stakeholders in those states should be promoting Regulation Crowdfunding as an alternative for of fundraising.

While California may lead in the number of offerings and the overall dollars committed they do not lead when it comes to the average amount raised by campaign. If we look at data from campaigns that closed and exceeded their Minimum Funding Target, (and we require at least 5 successes in a State to add some credibility to the averages) we find that Massachusetts leads the way with $445,000 on average (n=6), followed Texas $312,000 (n=15), New York $278,000 (n=6) and then California $255,000 (n=54). The average of all successfully funded campaigns for the first fiscal year was $302,000. The takeaway here: In the first year, entrepreneurs in Massachusetts and Texas raised more per campaign than the national average. A key reason stakeholders in those states should be promoting Regulation Crowdfunding as an alternative for of fundraising.

Which States Have Engaged the Most Investors?

Next, we look the size of the crowd that is investing in 2 ways: First, the total number of investors in the state. California led the way with over 21,750 people investing in Regulation Crowdfunding campaigns. Texas followed with 4,500 investors, New York with 3,900 investors, and Connecticut with over 2,500 investors. Interestingly, Massachusetts, Utah, Delaware, Colorado, Alabama, Idaho, Washington and Ohio all had over 1,000 backers.

Second, we looked at the average number of investors in a campaign, by state. Interestingly, Massachusetts leads with the highest average number of backers 595, followed by New York (518), California (368) and Texas (352).

Which States Have Investors Making the Largest Average Investments?

Finally, we answer the question where do investors write the largest checks? Texas leads with the average check size of $1,364 for campaigns that hit their Minimum Funding Target. Colorado at $1,154, Delaware follows at $962 followed by California at $847 and New York at $537.

Is this early data? Yes, this is just the first years’ worth of data. Are the number of campaigns still small at this point? Yes but they are growing every day and we have controlled the data where possible for statistical significance. Is there any indication of where this may lead? Sure.

Is this early data? Yes, this is just the first years’ worth of data. Are the number of campaigns still small at this point? Yes but they are growing every day and we have controlled the data where possible for statistical significance. Is there any indication of where this may lead? Sure.

When we look at the UK data, we can see significant market growth in years 2 and 3 regarding campaign size, total number of campaigns, and average investment. We expect to see similar dynamics in the US over the next 12 months. Will we see different states building expertise in using different types of securities or becoming more successful in crowdfunding different industries? The data is beginning to show that to be true. Will the time to reach funding goals decrease over time as more people become familiar with securities-based crowdfunding? Stay tuned…we will continue to report on the data to provide early signals to the market.

Jason Best is co-founder and Principal of Crowdfund Capital Advisors (CCA), Jason Best co-authored the crowdfund investing framework used in the JOBS Act to legalize equity and debt-based crowdfunding in the USA. He has provided congressional testimony on crowdfunding and was honored to attend the White House ceremony when President Obama signed the JOBS Act into law on April 5, 2012. Jason co-founded the crowdfunding industry trade group that works with the Securities and Exchange Commission and FINRA as they create the rules for crowdfund investing. Jason also works with angel groups, PE/VC firms as well as governments and NGOs, including The World Bank, to understand the crowdfunding ecosystem and create successful crowdfund investing strategies. He was instrumental in the successful effort to have CCA selected by the US State Department’s Global Entrepreneurship Program as a Key Partner.

Jason Best is co-founder and Principal of Crowdfund Capital Advisors (CCA), Jason Best co-authored the crowdfund investing framework used in the JOBS Act to legalize equity and debt-based crowdfunding in the USA. He has provided congressional testimony on crowdfunding and was honored to attend the White House ceremony when President Obama signed the JOBS Act into law on April 5, 2012. Jason co-founded the crowdfunding industry trade group that works with the Securities and Exchange Commission and FINRA as they create the rules for crowdfund investing. Jason also works with angel groups, PE/VC firms as well as governments and NGOs, including The World Bank, to understand the crowdfunding ecosystem and create successful crowdfund investing strategies. He was instrumental in the successful effort to have CCA selected by the US State Department’s Global Entrepreneurship Program as a Key Partner.

Sherwood “Woodie” Neiss, is co-founder and Principal of Crowdfund Capital Advisors, is an expert at building successful businesses. As a 3-time INC500 winner whose company won E&Y’s Entrepreneur of the Year, Sherwood understands the keys to entrepreneurial success from concept to company to sale. As a serial entrepreneur and investor during the credit crunch, Sherwood saw a need for a change in outdated securities laws and did something about it—as a co-founding member of Startup Exemption, Sherwood co-authored the Crowdfunding Framework used in the JOBS Act that was signed into law by President Obama on April 5, 2012. Within Crowdfund Capital Advisors (CCA), Sherwood works with clients ranging from governments and banks that are looking for ways to boost economic development in their countries to investment firms looking for access to increased deal flow that crowdfunding creates. Sherwood serves as an advisor to several crowdfunding platforms and crowdfunding technologies giving him a unique understanding and view of the industry and market. As an industry leader, Sherwood contributes to several publications including VentureBeat and TechCrunch. He additionally wrote Crowdfund Investing for Dummies through Wiley & Son’s.

Sherwood “Woodie” Neiss, is co-founder and Principal of Crowdfund Capital Advisors, is an expert at building successful businesses. As a 3-time INC500 winner whose company won E&Y’s Entrepreneur of the Year, Sherwood understands the keys to entrepreneurial success from concept to company to sale. As a serial entrepreneur and investor during the credit crunch, Sherwood saw a need for a change in outdated securities laws and did something about it—as a co-founding member of Startup Exemption, Sherwood co-authored the Crowdfunding Framework used in the JOBS Act that was signed into law by President Obama on April 5, 2012. Within Crowdfund Capital Advisors (CCA), Sherwood works with clients ranging from governments and banks that are looking for ways to boost economic development in their countries to investment firms looking for access to increased deal flow that crowdfunding creates. Sherwood serves as an advisor to several crowdfunding platforms and crowdfunding technologies giving him a unique understanding and view of the industry and market. As an industry leader, Sherwood contributes to several publications including VentureBeat and TechCrunch. He additionally wrote Crowdfund Investing for Dummies through Wiley & Son’s.