Bitcoin

Bitcoin Decentralization and Where to Find It

Introduction

Google News Recentlyheard

Considered one of Bitcoin’s plain and regularly touted strengths is its decentralization. It is usually claimed that the Bitcoin community provides ranges of decentralization, accessibility, and distribution unmatched by another cryptocurrency. However simply how decentralized is Bitcoin in actuality? And the way can we go about measuring its decentralization? Earlier than delving into these questions, it is essential to make clear the ideas of centralization and decentralization, as they’re usually muddled.

To supply a transparent definition, the centralization/decentralization dynamic may be understood because the diploma of focus/diffusion of authority among the many members in a system. Right here, “authority” refers back to the energy to affect the functioning and guidelines of the system, whether or not for malicious or benign functions. With this in thoughts, measuring the diploma of centralization in a system includes quantifying the minimal variety of entities, members, required to change its functioning or guidelines. The decrease this quantity, the larger the diploma of centralization. In a seminal 2017 paper on the topic, Balaji S. Srinivasan and Leland Lee launched an insightful metric for this goal: the Nakamoto coefficient.

Derived from the Lorenz curve utilized in calculating the Gini coefficient, the Nakamoto coefficient identifies the minimal variety of members essential to compromise or management the system. For example, within the well-known state of affairs of Bitcoin’s hashrate, if we assume that 5 mining swimming pools collectively possess 50%+1 of the full hashrate, then this quantity could be 5. Because of this a easy majority of fifty% of the hashrate could be satisfactory to execute a double spending operation on the blockchain. Nonetheless, the vital threshold might fluctuate for different variables.

Completely different sides of centralization

Now, let’s handle the core problem recognized by the authors of the paper: figuring out subsystems vital to the functioning of the system. In terms of Bitcoin, focusing solely on the focus of hashrate (i.e., miners) fails to seize the total spectrum of centralization/decentralization inside the community and overlooks the potential for a 50%+1 assault.

Balaji S. Srinivasan and Leland Lee, of their article, suggest 5 extra measurable subsystems of the Bitcoin Community: shopper platform, code builders, nodes, custodial/exchanges, and possession.

Based on Balaji S. Srinivasan, the six dimensions of centralization inside the Bitcoin community are as follows:

• Consumer centralization

• Possession centralization

• Node centralization

• Builders centralization

• Custodial/exchanges centralization

• Hashrate centralization

As well as, we would contemplate including one final dimension:

- {Hardware} Centralization

Whereas this checklist is complete, what’s missing is a qualitative evaluation of those dimensions. Which amongst them are actually pivotal for Bitcoin’s community performance, and which aren’t?

For example, one might argue that the shopper or possession variables aren’t as essential in measuring Bitcoin’s decentralization.

Within the first case, Bitcoin Core stands because the de facto normal shopper at this time. Nonetheless, it is price noting that that is an open-source software program authored by Satoshi Nakamoto himself. So long as it stays open-source, actively maintained, and monitored, its dominance would not essentially equate to vulnerability. It is vital to acknowledge the excellence between Bitcoin Core’s hegemony reasonably than a monopoly, as theoretically, different operational purchasers exist—comparable to Bitcoin Knots, BTCD, Libbitcoin, BitcoinJ, Bitcoin Limitless, Gocoin—that may help the Bitcoin protocol. But, in apply, only a few community nodes make the most of these alternate options, favoring Nakamoto’s authentic implementation. On this regard, in 2010, Satoshi Nakamoto himself mentioned: “I do not consider a second, appropriate implementation of Bitcoin will ever be a good suggestion.” Injury qualitative evaluation from 1 to five: 2

As for the second dimension listed above – the distribution of Bitcoin possession – this undoubtedly has important socio-economic implications but it surely would not instantly have an effect on Bitcoin’s infrastructure. Since Bitcoin depends on a proof-of-work algorithm, the facility that Bitcoin homeowners have over nodes and protocol operation is actually nil. The centralization of sat possession might solely change into problematic if forex focus reaches such excessive ranges that undermine the community impact, impacting sensible use as a medium of alternate and retailer of worth. Luckily, as polarized as Bitcoin wealth could also be, we’re removed from this level and based on numerous analyses, as Bitcoin adoption will increase, the focus of sats step by step decreases. Injury qualitative evaluation from 1 to five: 3

Conversely, subsystems like nodes and coding are pivotal for reaching true community decentralization, being doubtlessly essentially the most vital factors inside the Bitcoin system. The danger of node takeover and subsequent laborious forks or coordinated malicious actions on the protocol poses important and lasting threats to community belief. Nonetheless, the likelihood of such occurrences is already low and have continually decreased over time, given the rising variety of energetic or shortly activatable nodes (roughly 16 thousand and 53 thousand respectively, based on the most recent recognized knowledge) and their distribution throughout completely different areas, entities, and authorized jurisdictions. Injury qualitative evaluation from 1 to five: 5

Within the latter case, the focus of Bitcoin Core code builders – the so-called Core builders and maintainers – stays very excessive and arguably growing from a sure perspective: there are comparatively few programmers actively concerned in writing and sustaining the shopper regardless of it being a vital perform for the complete technological infrastructure of the Bitcoin community. As of at this time, on common, between 40 and 60 builders contribute to this job every month with commits based on GitHub knowledge. They resolve voluntarily and independently when and easy methods to contribute to the event of Bitcoin Core software program on GitHub. In apply, over time, there was a reasonably excessive turnover inside this neighborhood of builders: it contains each historic builders courting again to the early variations of Bitcoin Core and plenty of newcomers who’ve joined extra lately. Many historic figures have left over time, whereas others have re-aggregated later, some function persistently and repeatedly, others in a restricted and sporadic method. Inside this group, which doesn’t have a formalized hierarchy (and the way might it, being Bitcoin an open-source mission?), there are even fewer key builders, those that pull the strings of the neighborhood’s work. Based on GitHub knowledge, from its beginnings, 30% of the recognized commits to the Bitcoin Core grasp repository had been made by solely 2 builders, and particularly, virtually 25% (that means 7347 out of a complete of 29,822 detected commits) by Wladimir van der Laan alone, the previous Bitcoin’s Lead Maintainer. After his departure in 2022, there has not been a single coordinator of labor on the Bitcoin Core code, however his monumental contribution stays undisputed. As of at this time, guiding the work on Bitcoin Core growth is a restrictive management made up of some senior builders together with Gennady Stepanov, Michael Ford, Ava Chow, and Gloria Zhao, every specializing in overseeing a selected part of the shopper.”

One would possibly surprise if such a small and decentralized group of builders/maintainers contributing to the code at this time may be the Achilles’ heel amongst Bitcoin’s numerous subsystems, making the complete construction weak to assault. An enormous, complicated, and extremely priceless (not solely economically) infrastructure like at this time’s Bitcoin community depends on the usually part-time and principally unpaid work of some passionate supporters and maintainers. On the one hand, it is true that particular person nodes have the ultimate say on the adoption of every new replace/model of the Bitcoin Core shopper by the consensus mechanism. Alternatively, one would possibly query what number of nodes truly analyze the brand new code for vulnerabilities, dangerous modifications, or bugs earlier than putting in it.

What would occur if, hypothetically, gradual infiltrations of saboteurs occurred inside the restricted circle of Key Core builders and Maintainers, with the intention of first gaining belief and affect locally after which hacking the brand new variations of the code? They may, for instance, disguise digital time bombs inside them (within the type of bugs or zero-day vulnerabilities). It is a Machiavellian and complicated speculation to execute, however not unimaginable, particularly if we contemplate a gradual, covert operation carried out by entities with important monetary, human, and technological assets at their disposal and with a powerful motivation to disrupt the community, such because the intelligence service of a strong state. What could be the results of such an operation on Bitcoin if it had been profitable? Most likely fairly severe, if not existential. It might unleash chaos amongst nodes that unwittingly applied the corrupted replace, resulting in compelled laborious forks with results on the soundness, integrity, and belief within the Bitcoin community. What a technological brute pressure assault could not accomplish, social engineering aimed toward dismantling consensus might. It is tough to estimate the likelihood of success of such an assault on the Bitcoin Core code, however the small variety of people overseeing its growth and upkeep, and the relative lack of curiosity from the broader person neighborhood of their priceless work (and, final however not least, their remuneration), make this subsystem notably weak to a well-conceived assault. Injury qualitative evaluation from 1 to five: 4

When contemplating the realm of custodial and alternate companies, the pattern towards larger or lesser centralization is not solely clear-cut. Whereas their numbers have soared because the early days of Bitcoin (suppose MtGOX), the lion’s share of buying and selling volumes in opposition to fiat currencies at this time stays concentrated amongst a choose few main gamers (Binance, Bybit, Coinbase, OKX, Kraken, Bitfinex, and so forth.). Particularly, as of at this time, three main entities maintain greater than 55% of the Bitcoin held in custody by third events, whereas simply Binance guidelines the amount of fiat-BTC transactions with 30% of whole public exchanges. The dangers stemming from extreme centralization on this particular subsystem aren’t a lot tied to the safety of the Bitcoin community itself, however reasonably to its convertibility with fiat currencies and the safety of these delegating custody (i.e., all these Bitcoin customers entrusting their sats and therefore their “bodily” possession).

Within the first state of affairs, heightened centralization (a discount within the variety of exchanges) would render the system extra weak to coordinated authorized or cyberattacks aimed toward disrupting and doubtlessly severing the hyperlink between fiat currencies and Bitcoin. This follows the logic that fewer doorways make for simpler locking. Within the second state of affairs, below an oligopolistic regime, these choosing custodial options as an alternative of self-custody would face elevated counterparty threat. This could end result from the diminished bargaining energy of customers in direction of custodial counterparts, who might then impose extra burdensome financial circumstances and extra oppressive clauses (for instance, concerning entry to custodied bitcoins) than they may in a aggressive setting.

Furthermore, with only some massive operators able to controlling important bitcoin portions on behalf of their purchasers, the danger of abuses (comparable to non-consensual fractional reserve practices), hacking (the richer the goal, the extra interesting), and political-regulatory interference (together with collusion with public authorities, extreme regulation, and bureaucratization) could be significantly increased in comparison with a extra fragmented and aggressive custodial system.

On the far finish of this counterparty threat spectrum lies the potential for a 6102 assault: the large-scale seizure of bitcoins held on exchanges and custodial wallets inside a sure jurisdiction by legislative motion. Whereas this would not instantly influence the functioning of the Bitcoin community, it might possible undermine belief in Bitcoin as a safe technique of cost and retailer of worth among the many normal public, thereby jeopardizing its success as a free permissionless forex. Injury qualitative evaluation from 1 to five: 3

We cannot dwell a lot on the hashrate/mining subsystem as each the difficulty of its decentralization and the potential for 51% assaults have been analyzed and dissected numerous occasions by way more authoritative sources. We solely recall right here the most typical assault situations: double spending assault, selective transaction censorship, and empty block assault. The results of such assaults might be terrible and shouldn’t be underestimated, however there’s a huge literature explaining the constraints of this sort of assault and the countermeasures that might be adopted by the node consensus to thwart it or at the very least successfully counteract it. Nonetheless, all in all, it stays some of the delicate and weak subsystems, if solely attributable to its diploma of centralization. Actually, two mining swimming pools – Foundry USA and Antpool – at the moment management greater than 50% of the hash fee. Injury qualitative evaluation from 1 to five: 4

Lastly, turning to the {hardware} dimension (initially absent within the work of Balaji S. Srinivasan and Leland), we have to analyze the diversification of mining tools when it comes to producers, fashions, and their respective market shares of Bitcoin’s hashrate. It is plain that these days the variety of {hardware} producers for mining (ASICs) has considerably elevated in comparison with the previous. Main firms within the sector embrace Bitmain, Whatsminer, Canaan, Zhejiang Ebang Communication, Halong Mining, Helium, Bitfury, Bee Computing, and HIVE Blockchain. Nonetheless, the full hashrate of miners is at the moment dominated by just a few ASIC fashions and even fewer producers. Based on current estimates by Coinmetrics, over 70% of the worldwide hashrate is produced by ASICs from a single main firm, Bitmain. Moreover, together with simply three different producers (Whatsminer, Canaan, and Ebang) accounts for nearly all the computational energy utilized by the Bitcoin community. Furthermore, the overwhelming majority of the hashrate is generated by solely seven ASIC fashions from these aforementioned firms: Antminer S19xp, Antminer S19jpro, Antminer S19, Canaan 1246, Antminer S17, MicroBT m20s, and MicroBT m32.

The dangers of such centralization of {hardware} when it comes to fashions and producers are quite a few. With only a few massive producers, primarily now positioned in China, they may simply be compelled by governments and lawmakers of the jurisdictions they’re topic to, to halt manufacturing of their amenities, hand over batches of manufactured {hardware}, or secretly infiltrate backdoor {hardware} and trojans into their ASIC fashions. The results would instantly influence the mining subsystem, inflicting instability and doubtlessly a collapse within the community’s hashrate, leading to important financial losses for miners utilizing corrupted ASICs or these unable to accumulate new ones. A considerably decrease and extended hashrate would scale back the safety of the complete community, as it might enhance the probabilities of a 51% assault, maybe exactly by the actor who initiated the {hardware} assault. Right here, we see how an assault on one poorly decentralized subsystem can nearly weaken one other and thus assault it in a harmful chain response with harmful penalties for the integrity of the Bitcoin community. Injury qualitative evaluation from 1 to five: 3

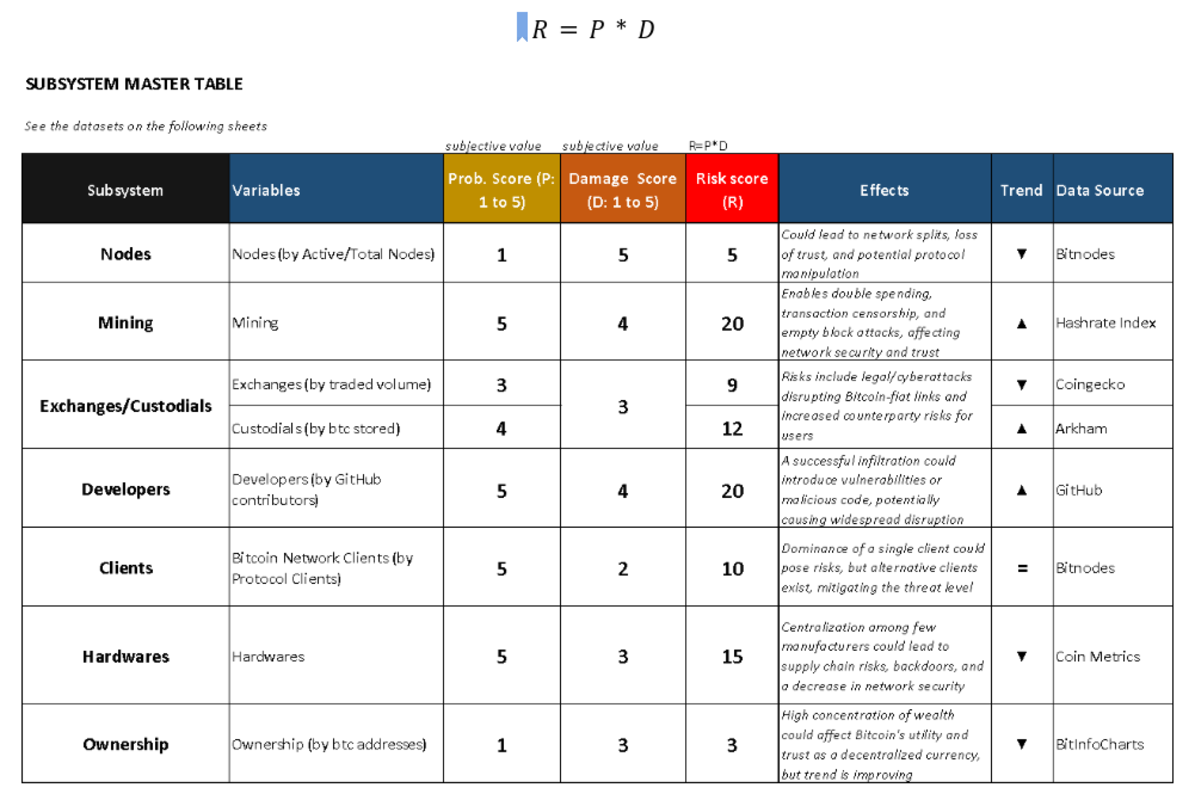

Given this non-exhaustive overview of the assorted subsystems of Bitcoin and their vulnerabilities, we are able to endeavor to synthesize the six dimensions right into a single desk. This desk would measure the danger of centralization as a matrix between likelihood (P) and injury incidence (D, i.e.: the relevance of results on the community), illustrating the dynamics towards growing or reducing centralization.

A likelihood rating (P) is assigned on a scale from 1 to five primarily based on an inverse and non-linear perform of the variety of entities required to succeed in a given vital centralization threshold. In different phrases, the larger the variety of present entities required to succeed in a sure threshold, the decrease the likelihood rating. The aforementioned threshold is a share (generally subjectively outlined) of the full estimated variety of entities taking part in a given subsystem, past which the system turns into critically weak to compromise. In some circumstances, this threshold is goal, as within the case of the mining dimension, whereas in others it’s extra arbitrary, comparable to within the case of builders or the shopper; nonetheless, generally, it might be understood because the tipping level of centralization.

A injury variable (D) can be assigned a rating from 1 to five. That is attributed in relation to the unfavourable penalties anticipated from an assault on the particular subsystem on the safety, stability, and performance of the Bitcoin community as a complete.

This latter rating is clearly subjective and undoubtedly might be topic to criticism and subsequent revisions by extra in-depth analyses.

Lastly, the particular threat rating, which summarizes the danger of centralization of every subsystem, is obtained from the product of those two scores.

Geographical and Financial Decentralization

Different variations of the decentralization/centralization dichotomy may be recognized, which reduce throughout the seven sorts simply illustrated: geographical (jurisdictions) and financial (financial entities). Geographical decentralization addresses the query: the place are the nodes, wallets, exchanges/custodians, and miners bodily and legally positioned? Financial decentralization, however, considerations the financial possession of those entities: for instance, who owns the mining swimming pools? Or who controls the exchanges? The geographical and financial facets could seem overlapping at first look, however in actuality, they don’t seem to be in any respect. For example, there might be a Bitcoin ecosystem the place there are numerous impartial miners, however all positioned inside the identical jurisdiction and thus topic to the identical political-legal threat. Right here, financial/possession centralization could be low, whereas geographical centralization could be very excessive. Conversely, there might be many miner factories scattered throughout the globe however managed by the identical financial entity and due to this fact successfully thought-about as a single level of failure. The identical argument might equally apply to nodes, {hardware} or bitcoin possession. In a world dominated by states and enormous companies, neglecting these elements may be deadly. The mere variety of members in a Bitcoin subsystem tells us little about decentralization if they’re principally concentrated in a single jurisdiction or topic to the identical financial management. Subsequently, each the qualitative geographical parameter and the financial parameter ought to be built-in into any try and measure the diploma of decentralization of the Bitcoin community.

What modifications with ETFs?

The current emergence of Bitcoin ETFs within the US market might have a substantial influence on the decentralization of the community, notably regarding the Custodial/Exchanges subsystem. Whereas investing in an ETF considerably simplifies entry to bitcoin efficiency in comparison with different fiduciary options, this feature doubles (if not triples) the counterparty dangers for buyers. Those that “spend money on bitcoin” by an ETF don’t truly possess or personal the belongings; they’re topic to each the counterparty threat of the ETF supervisor and that of the Custodial/Depository to which the ETF depends on (if the supervisor doesn’t go for an unlikely self-custody), in addition to the danger of the middleman/dealer by which they purchase the instrument. In apply, the adage “Not your keys, Not your cash” reduces to a easy “Not Your Cash, goodbye” particularly within the case of an hypothetical 6102 assault utilized on ETFs.

On a macro stage, the identical arguments made for custodial/alternate entities apply to passive funds on Bitcoin: the extra they’re utilized by institutional and retail buyers as a type of “funding in bitcoin,” the extra bitcoin is absorbed into their lots. Consequently, their coercive energy over customers and contractual (i.e., financial) energy over different subsystems of the Bitcoin Community enhance. If a selected Bitcoin ETF had been to accumulate a major (if not dominant) market share of circulating bitcoin over time and systematically use its proceeds to subsidize builders of the Bitcoin Core shopper, it might affect their actions, information shopper implementations, and thus the event path of the complete community in direction of its needs. This could be a case the place the centralization of 1 dimension (that of custodians by ETFs) results in the centralization of a way more very important dimension: that of builders mentioned earlier.

Conclusions

Upon analyzing numerous dimensions of decentralization inside the Bitcoin community, two vital subsystems come to the forefront attributable to their important relevance and present restricted decentralization: the mining/hashrate subsystem and the coding/builders subsystem. Whereas discussions across the former have been ongoing because the inception of the Bitcoin mission, with debates on quite a few 51% assaults and their options, the latter has largely been neglected or underestimated by analysts. Regardless of the traditionally sincere and clear habits of core builders, whose intentions have persistently aimed on the real success of the expertise, this doesn’t assure the identical conduct sooner or later.

The numerical shortage of Bitcoin Core builders, coupled with the disproportionate code contributions from a choose few people in comparison with the full members, poses dangers of infiltration, hacking, and social manipulation that can not be downplayed. The inadequate variety of builders to make sure an attack-proof stage of decentralization would possibly stem from their restricted recognition and monetary rewards inside the Bitcoin person base and the broader international programming neighborhood.

Whereas miners have a monetary incentive predetermined by the protocol itself to take part constructively and faithfully within the community, the identical can’t be mentioned for shopper programmers who lack predetermined, neutral, or proportional remuneration for the amount and high quality of their work. These amongst them who haven’t enriched themselves with Bitcoin within the community’s early days and/or don’t act out of selfless altruism, should depend on grants, scholarships, and donations from third-party philanthropic entities to maintain themselves. The principle subsidies to Bitcoin Core builders at the moment come from numerous organizations and corporations within the Bitcoin Financial system comparable to OpenSats, Spiral, Sq. Crypto, Chaincode, MIT DCI, Blockstream, Gemini, Coinbase, BitMEX, Hardcore Fund, and so forth. Their contribution is essential, however their generosity shouldn’t be essentially impartial or disinterested. It’s not a nasty factor in itself, however what would occur if different much less benevolent donors, who possible have intentions and pursuits not aligned with the success of Bitcoin, had been to take their place?

This raises considerations about potential interference from much less benign donors, which might compromise the safety and stability of the complete Bitcoin community. The restricted numbers, advert hoc collaborations, and unsure financial incentives make the function of core builders unattractive to most programmers, rendering them weak to corruptive or manipulative actions.

To deal with these challenges and incentivize the independence, participation, and retention of core builders, we define just a few concepts right here.

At one excessive, we might have devoted micro-crowdfunding platforms that completely present restricted, non-refundable donations from donors to keep away from imbalances and undue influences from just a few people. On the different finish, a multilateral settlement – optionally available however technically binding for signatories – among the many massive gamers within the Bitcoin ecosystem (miners, ETFs, exchanges, and so forth.) during which they commit, verifiably by all, to contribute a predefined share of their earnings to Bitcoin Core builders, thus subjecting themselves to a sort of voluntary self-taxation.

In each circumstances, technical implementation of incentive techniques might make the most of DAOs, good contracts, and layer-2 options to manage standards for disbursement and anonymize cost flows to builders.

Naturally, the 2 concepts talked about usually are not mutually unique or conclusive. Even much less ought to they be imposed from above. We contemplate them easy grassroots concepts to provoke a severe debate on the necessity to worth the important thing function of Bitcoin programmers with out undermining their autonomy. A debate that, in our modest opinion, ought to be urgently reopened amongst all those that consider within the worth of this revolutionary expertise.

This can be a visitor submit by Michele Uberti. Opinions expressed are solely their very own and don’t essentially mirror these of BTC Inc or Bitcoin Journal.

-

News4 weeks ago

News4 weeks agoCowboy Carter Review: Every Thought We Had While Listening to Beyoncé’s New Album

-

News4 weeks ago

News4 weeks agoLizzo says she’s tired of ‘being dragged’ by online critics: ‘I quit’ | Lizzo

-

News4 weeks ago

News4 weeks agoLizzo Announces That She’s Quitting With Emotional Instagram Post

-

News4 weeks ago

News4 weeks agoConjoined twins Brittany and Abby Hensel respond to ‘loud’ comments after Josh Bowling wedding reveal – NBC4 Washington

-

News4 weeks ago

News4 weeks agoAnother Old Guide To Truck Liveries, But Simpler: Cold Start

-

News4 weeks ago

News4 weeks agoDiamondbacks set franchise record and Opening Day record with 14 runs in 1 inning vs. Rockies

-

News4 weeks ago

News4 weeks agoHow many rainouts has the team, Petco Park had?

-

News4 weeks ago

News4 weeks agoSheryl Crow Opens Up About Olivia Rodrigo Friendship